Content

Put simply, the company confirms that it has legal authority and control of all the rights and obligations highlighted in the financial statements. Auditors test accounts receivable existence through both confirmation and examination of documentation. Customer confirmation, because it is from a third-party, is considered to be the strongest form of audit evidence for accounts receivable. However, the company’s customers often do not return requests for confirmation. In these cases, the auditor will examine cash receipts related to the accounts receivable that were received after year end.

He is attentive to his clients’ needs and works meticulously to ensure that each examination and report meets audit assertions professional standards. Classification — the transactions have been recorded in the appropriate caption.

Linkage with Further Audit Procedures

The assertions form a theoretical basis from which external auditors develop a set of audit procedures. These assertions are noted below. Accounting management assertions are implicit or explicit claims made by financial statement preparers.

These accounts are all part of the balance sheet and should therefore stay in the same cycle. These accounts should be in the same cycle because there are more transactions in these accounts than any other. Both A and B are correct. SOX also created the Public Company Accounting Oversight Board —an organization intended to assess the work performed by public accounting firms to independently assess and opine on management’s assertions. The PCAOB’s Auditing Standard number 5 is the current standard over the audit of internal control over financial reporting. Think of assertions as a scoping tool that allows you to focus on the important. Not all assertions are relevant to all account balances or to all disclosures.

Are Financial Accounting Assertions Important in Auditing?

Distinguish between the existence and completeness balance-related audit objectives. State the effect on the financial statements (overstatement or understatement) of a violation of each in the audit of accounts receivable. The existence objective deals with whether the account balances are correct on the financial statements. The completeness objective deals with whether the financial statements are not overstated. The existence objective refers to amounts being included in the correct amount.

- Management, investors, shareholders, financiers, government, and regulatory agencies rely on financial reports for decision-making.

- This is an example of the valuation, and this assertion needs to be verified by the auditor in order to evaluate the overall preparation of financial statements.

- The cycle approach requires an audit of each account on the financials, starting with sales on the income statement and finishing with stockholders’ equity on the balance sheet.

- Distinguish between the existence and completeness balance-related audit objectives.

- This is about the categorization of different accounts, into their respective heads.

- How does this responsibility differ for laws and regulations that have a direct effect on the financial statements compared to other laws and regulations that do not have a direct effect?

Each also provides the assertion meaning or definition to help one understand how each is used in an assessment. Cutoff — the transactions have been recorded in the correct accounting period. You may be wondering if financial statement level risk can affect assertion level assessments. For an auditor, relevant assertions are those where a risk of material misstatement is reasonably possible. So, magnitude (is the risk related to a material amount?) and likelihood (is it reasonably possible?) are both considered. This is because of the need to ensure that related disclosures are relevant and understandable in the context of the requirements of the applicable financial reporting framework that is in context.

IAASB Handbook of international quality control, auditing, review, other assurance, and related services pronouncements

A service organization can greatly reduce the number of resources expended to meet user auditors’ requests by having a Type II SOC 1 audit performed. Existence Assertion – Assets, liabilities, https://www.bookstime.com/ and equity balances exist at the period end. Classification Assertion – Transactions have been classified and presented fairly in the financial statements. Thank you Charles for this article!

What are audit assertions and examples?

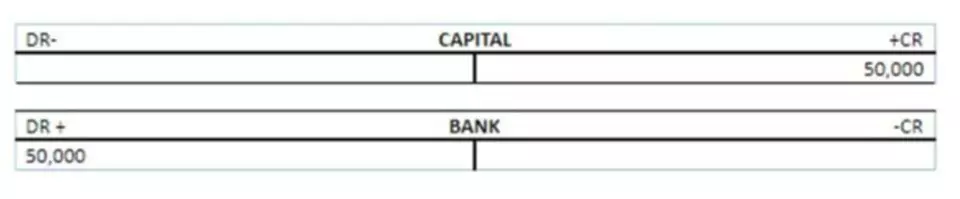

Auditors use this assertion to confirm assets, liabilities, and equity recorded in a company's financial statements actually belong to that same company. Examples include: Verifying bank account balances are actually owned by the business being audited.

Also, auditor may ask for third-party verification of balance as on the said date. A simple question arises is “who has asked the auditor to check the same”? The auditing standards are applicable to the auditors. Those standards require the audit to comply with the requirements.

Completeness — all balances that should have been recorded have been recorded. Completeness — all transactions that should have been recorded have been recorded. Yes, usually the smaller the entity is, the harder it is to create good controls.

- The suitability of the design and operating effectiveness of the controls to achieve the related control objectives included in the description throughout a specified period.

- Explore the definition of substantive procedures, and study its importance along with examples.

- Good tone at the top, good accounting systems and processes, ”good people” etc, as there are no formal controls.